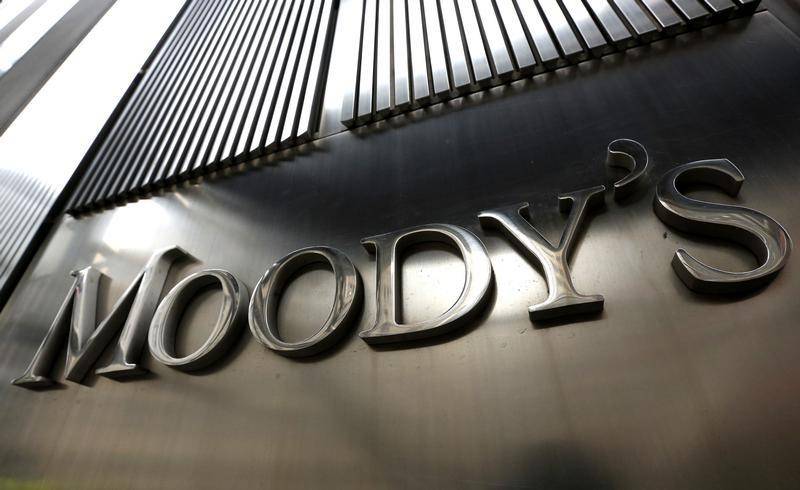

Moody’s Investors Service has downgraded the long-term deposit ratings to Caa1 from B3 of five Pakistani banks…reports Asian Lite News

Warning that Pakistan is on the brink of a “debt default”, renowned economist Steve Hanke said that Pakistan Prime Minister Shehbaz Sharif is failing to save the “sinking ship.”

“Its sovereign bonds have lost more than 60 pc of their value this year. I’m not surprised. PM Sharif’s government is failing to save the sinking ship,” he wrote on his official Twitter handle on Friday.

Moody’s Investors Service has downgraded the long-term deposit ratings to Caa1 from B3 of five Pakistani banks. The rating agency has also downgraded the five banks’ long-term foreign currency Counterparty Risk Ratings (CRRs) to Caa1 from B3.

The banks, which have been downgraded include Allied Bank Limited (ABL), Habib Bank Ltd. (HBL), MCB Bank Limited (MCB), National Bank of Pakistan (NBP) and United Bank Ltd. (UBL).

“As part of the same rating action, Moody’s lowered the Baseline Credit Assessments (BCAs) of ABL, MCB and UBL to caa1 from b3, and as a result also downgraded their local-currency long-term CRRs to B3 from B2 and their long-term Counterparty Risk Assessments to B3(cr) from B2(cr). The BCAs of NBP and HBL were affirmed at caa1,” Moody’s said in a statement.

“The outlook on all banks’ deposit ratings remains negative,” it added. The downgrading of Pakistan banks reflects the government’s reduced capacity to support the banks, which has affected the banks whose ratings benefit from government support.

The reduced ratings also show the high credit linkages between the banks’ balance sheets and sovereign credit risk, which constrains the banks’ Baseline Credit Assessments at the level of the Caa1-rated government; and the lowering of Pakistan’s foreign currency ceiling to Caa1, which has affected the foreign currency CRRs of all rated banks.

Pakistan rejected Moody’s decision to downgrade its banks. The Shehbaz Sharif government said it was taken unilaterally and did not depict the true picture due to information gaps and contradictions.

Pakistan Finance Minister Ishaq Dar said he would give a “befitting” reply in a meeting with its officials if the agency did not reverse the downgrade.

“They (Moody’s officials) have to meet me. I told them if you don’t [reverse] this, I will give you a befitting response in our meeting next week,” he was quoted as saying by Dawn. (ANI)