Moove aims to launch 5,000 CNG and electric vehicles within the first year and plans to scale to 30,000 over the next five years in India…reports Asian Lite News

Ride-hailing major Uber on Monday announced to bring Moove, its largest vehicle supply partner in the Europe, the Middle East and Africa (EMEA) market, to India to help people buy new vehicles using a percentage of their weekly revenue, first in Mumbai, Bengaluru and Hyderabad, and become its driver-partners.

Founded in 2020, mobility fintech Moove embeds its alternative credit scoring technology onto ride-hailing platforms and leverages proprietary performance and revenue analytics to underwrite loans to drivers who have previously been excluded from financial services.

Moove aims to launch 5,000 CNG and electric vehicles within the first year and plans to scale to 30,000 over the next five years in India.

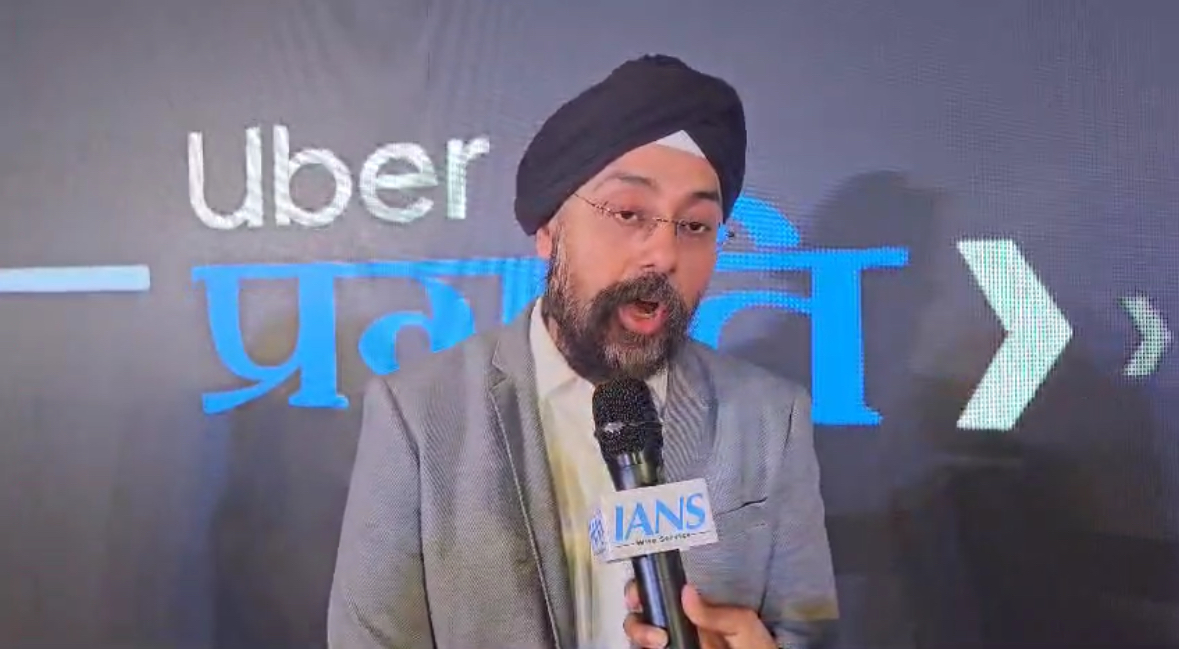

“Moove has created an innovative rent to own” model that provides a flexible option for drivers who want to get into the business of ride hailing without having to borrow from car owners or take bank loans to finance cars brought from dealerships,” said Abhilekh Kumar, Director, Business Development, Uber India South Asia.

“The addition of new cars will help provide superior customer experience to riders while creating sustainable earning opportunities for drivers on the Uber platform,” Kumar added.

The startup recently raised $105 million to expand across new markets in Asia and Europe.

With over 600,000 drivers on Uber in India, the launch will unlock an opportunity for Moove to provide accessible financing to thousands of drivers.

“We’re excited to be expanding our revenue-based vehicle financing model to enable the sustainable creation of jobs across the country, where there are some of the lowest vehicle ownership rates in the world, in part because of the lack of access to credit,” said Ladi Delano, co-founder and co-CEO at Moove.

Moove aims to be a global leader in the electrification of ride-hailing and mobility with a commitment to ensuring that 60 per cent of the vehicles it finances globally are hybrid or electric.