The Reserve Bank of India has hinted at further cuts in interest rates to maintain adequate liquidity in the system and counter the intensification of risks to growth and financial stability brought on by COVID-19.

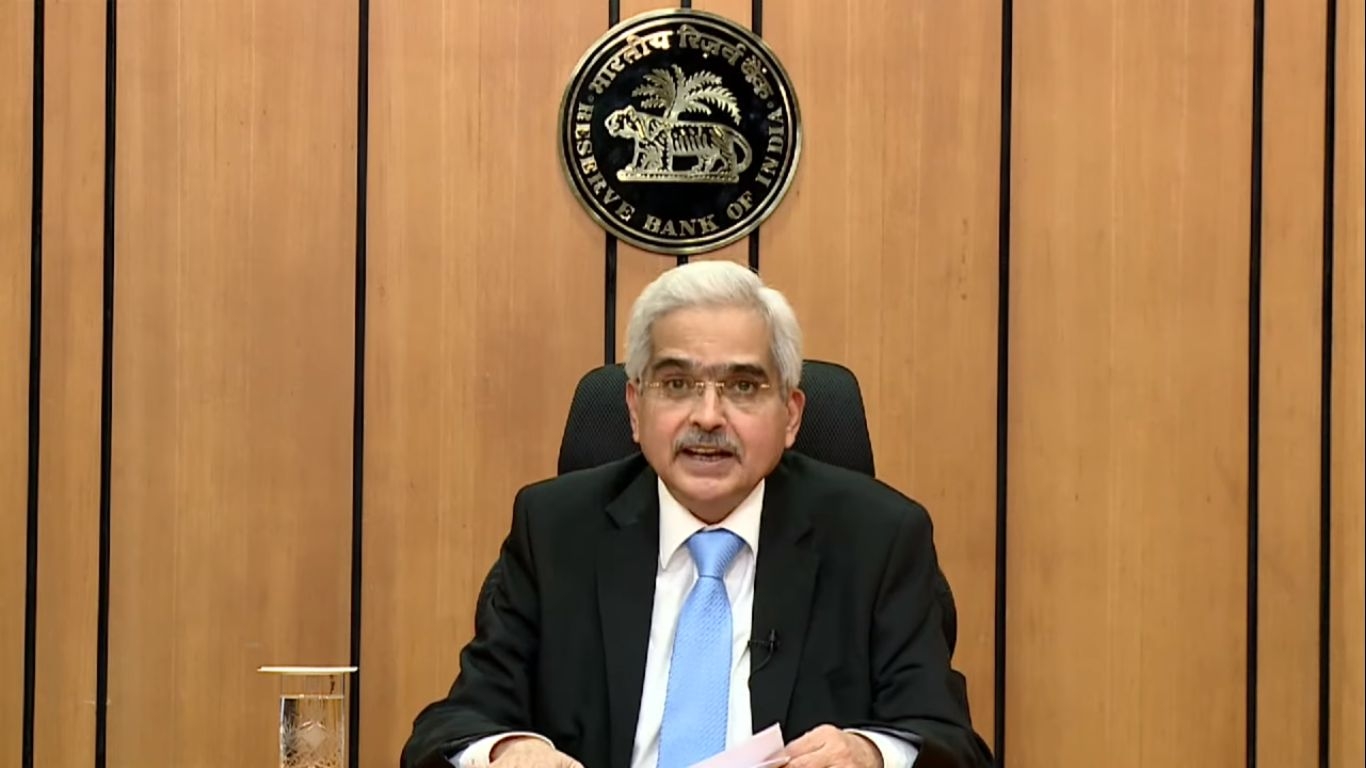

Announcing a raft of liquidity and regulatory easing of steps on Friday, RBI Governor Shaktikanta Das said that easing of inflationary pressure on the economy and the outlook that it is on a declining trajectory and could fall further “make policy space available to address the intensification of risks to growth and financial stability brought on by COVID-19.”

In a series of announcements, the RBI on Friday also cut reverse repo rate by 25 basis points to 3.75% , making it less attractive for commercial banks to park cash with the central bank. This is second cut in reverse repo rate in just about three weeks.

Earlier on March 27, RBI had slashed the repo rate by 75 basis points to 4.40 per cent from 5.15 per cent to help the economy fight the Covid-19 pandemic. Simultaneously, the reverse repo rate was cut by 90 basis points to 4 per cent from 4.90 per cent to ensure that banks don’t passively park funds with RBI and start lending to the productive sectors of the economy.

Second early developments suggest that inflation is on a declining trajectory, having fallen by 170 basis points from its January 2020 peak. In the period ahead, inflation could recede even further, barring supply disruption shocks and may even settle well below the target of 4 per cent by the second half of 2020-21, Das said while unveiling second instalment of measures aimed at providing liquidity in the economy and allow credit flows to grow.

“Such an outlook would make policy space available to address the intensification of risks to growth and financial stability brought on by COVID-19. This space needs to be used effectively and in time”, he added.

The RBI Governor said that the bank will monitor the evolving situation continuously and use all its instruments to address the daunting challenges posed by the pandemic.

“The overarching objective is to keep the financial system and financial markets sound, liquid and smoothly functioning so that finance keeps flowing to all stakeholders, especially those that are disadvantaged and vulnerable,” Das said

Earlier, the RBI governor cited the IMF projections that has put India among the handful of countries that is projected to cling on tenuously to positive growth (at 1.9 per cent) in 2020. In fact, this is the highest growth rate among the G 20 economies, Das said that this comes even as the global economy is expected to plunge into the worst recession since the Great Depression, far worse than the global financial crisis.

For 2021, the IMF projects sizable V-shaped recoveries: close to 9 percentage points for the global GDP. India is expected to post a sharp turnaround and resume its pre-COVID pre-slowdown trajectory by growing at 7.4 per cent in 2021-22, he said.

READ MORE:

RBI Announce Reduction in Reverse Repo Rate and New Measures