Highlighting the global challenge of balancing inflation control with growth, the PM urged the RBI to pioneer a model addressing this, potentially setting a global trend…reports Asian Lite News

Over the next 10 years, India must strive to become a ‘financially Atmanirbhar’ economy that is shielded from all global events and continues to march ahead confidently for progress and development, Prime Minister, Narendra Modi, said on Monday.

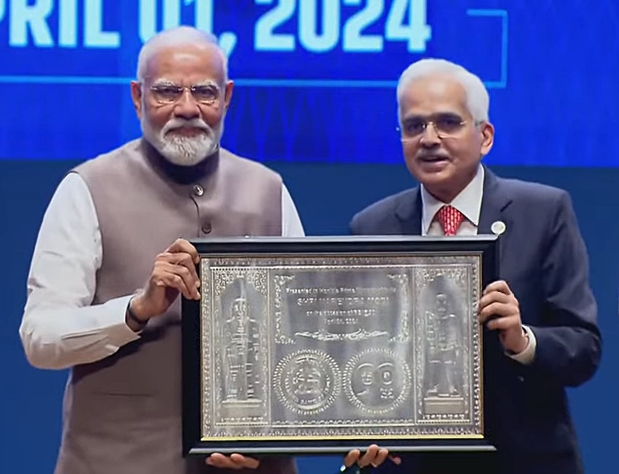

Speaking at the 90th anniversary celebrations of the Reserve Bank of India (RBI), the PM said that the country’s economy has risen in the last few years from the inherited mess of 2014 when the BJP government took office, and is now poised for take-off.

“India is among the youngest nations in the world… Our policies have opened up new sectors in the economy like green energy, digital technology, Defence which is getting into the export mode, MSMEs, space and tourism industries.

“The RBI must address the aspirations of the youth and develop ‘out-of-the-box’ policies for all these emerging sectors to help the youth,” urged the PM.

Pointing out that globally there is a challenge for nations to strike a balance between inflation control and growth, the PM called upon the RBI to study and develop a model for this, which can be a trendsetter for the world, especially the Global South, while ensuring that the Indian Rupee is accessible and acceptable world over.

He said that in the next 10 years, India will strive to improve its financial independence, with the country’s economy getting impacted minimally by global developments “as we are already on the way to becoming a world growth engine.”

Present at the celebrations were Union Finance Minister, Nirmala Sitharaman, RBI Governor, Shaktikanta Das, and other dignitaries.

Meanwhile, the RBI on Monday directed all banks to provide adequate incentives to their branches in financing the Self Help Groups (SHGs) and establish linkages with them, making the procedures simple and easy.

“The group dynamics of working of the SHGs need neither be regulated nor formal structures imposed or insisted upon. The approach towards financing the SHGs should be totally hassle-free and may also include consumption expenditures. Accordingly, the guidelines should be adhered to enable effective linkage of SHGs with the banking sector,” the RBI has stated in its master circular to all banks.

The circular states that no loan-related and ad hoc service charges or inspection charges should be levied on priority sector loans up to 25,000. In the case of eligible priority sector loans to SHGs/ JLGs, this limit will be applicable per member and not to the group as a whole.

The RBI has also pointed out that loans to SHGs are allowed to be classified under Priority Sector Lending (PSL) under the respective categories such as Agriculture, MSME etc.

The circular further states that SHGs, registered or unregistered, which are engaged in promoting savings habits among their members are eligible to open savings bank accounts with banks.

Bank lending to SHGs should be included in the branch credit plan, block credit plan, district credit plan and state credit plan of each bank. Utmost priority should be accorded to the sector in preparation of these plans. It should also form an integral part of the bank’s corporate credit plan, the circular added.

The circular highlights that SHGs have the potential to bring together the formal banking structure and the rural poor for mutual benefit. Studies conducted by NABARD in a few states to assess the impact of the linkage project have brought out encouraging and positive features like an increase in loan volume of the SHGs, a definite shift in the loaning pattern of the members from non-income generating activities to production activities, nearly 100 per cent recovery performance, significant reduction in the transaction costs for both the banks and the borrowers etc., besides leading to a gradual increase in the income level of the SHG members.

Another significant feature observed in the linkage project is that about 85 per cent of the groups linked with banks were formed exclusively by women, it adds.

ALSO READ: ATBL Leads India’s Green Energy Initiative