A total of 8.24 billion passenger trips were made in urban areas in April, an expansion of 47.9 per cent year on year….reports Asian Lite News

China handled a total of 780 million passenger trips via commercial transport in April, a surge of 141.1 per cent year on year, said the Ministry of Transport on Tuesday.

Among all types of commercial transport, road trips increased 49.7 per cent to 380 million, while the number of waterway trips soared 403.7 per cent to 21.76 million, Xinhua news agency reported citing the Ministry data.

A total of 8.24 billion passenger trips were made in urban areas in April, an expansion of 47.9 per cent year on year.

Ferries recorded the largest increase, followed by urban rail transit transport.

The Ministry’s data also showed that cargo volume, as well as cargo throughput at ports, maintained double-digit growth during the period.

Fixed-asset investment in transport reached 315 billion yuan ($44 billion) last month, up 13.6 per cent year on year, according to the Ministry.

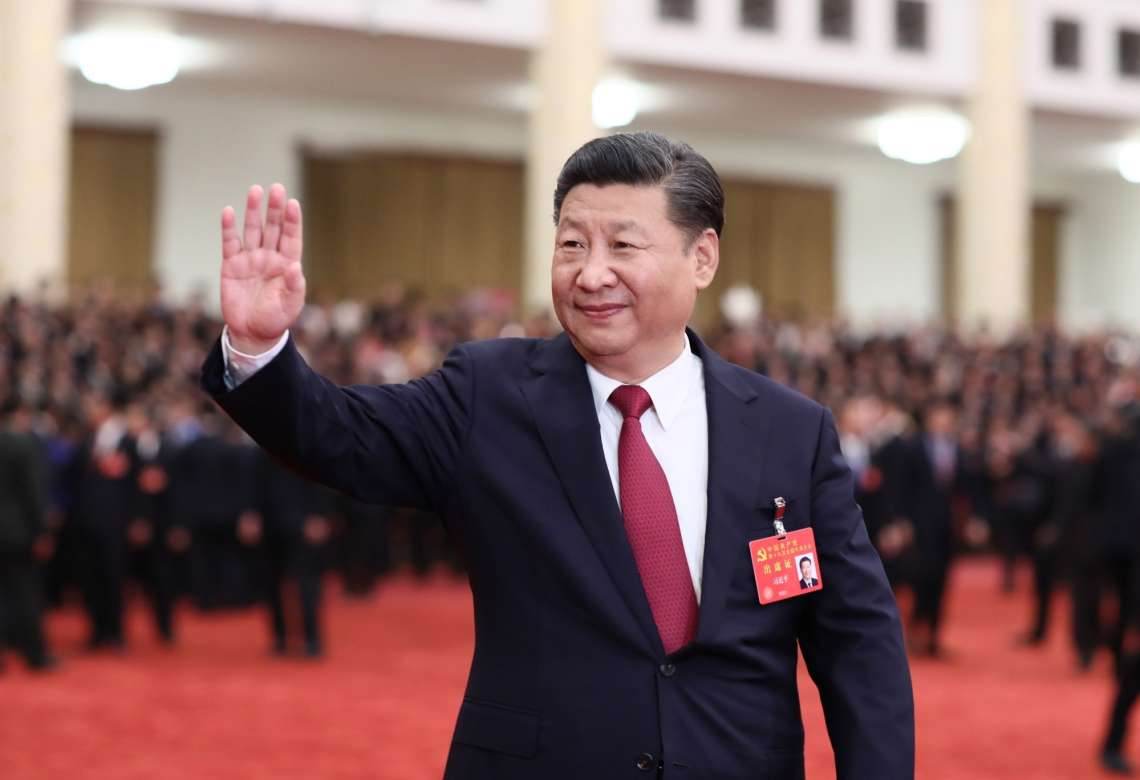

Slow economic recovery, deflation fears

A slowing economic recovery, deflation fears and risk-averse foreign investors have been affecting China’s financial markets, reducing both stock prices and the yuan’s value, Nikkei Asia reported.

Chinese economy bounced back after the government lifted its zero-COVID-19 restrictions in December. However, the recovery of the Chinese economy has lost steam, Noriyuki Doi said in the Nikkei Asia report. Chinese authorities have been using monetary stimulus to try to rev up the economy. However, the risks have driven the yuan even lower, as per the Nikkei Asia report.

After key economic indicators for April undershot market expectations, Goldman Sachs hinted at the risk of a reduction to its growth projection for China in the April-June quarter from the current 4.9 per cent, Nikkei Asia reported.

Goldman maintained the 6 per cent full-year forecast. However, it has warned that the slump could continue if confidence in the economy continued to be undermined, as per the news report.

The real estate sector, combined with related industries is estimated to account for 20 per cent to 30 per cent of gross domestic product. The real estate sector in China continues to suffer from sluggish demand, according to Nikkei Asia report.

The sale of new homes in China witnessed a decline of 11.8 per cent on th year in April, which shows a steeper drop than the 3.5 per cent in March. The fall in sales has dealt a blow to provincial governments, which generate a large portion of revenue from selling land-use rights to developers.

China is also facing protracted disinflation or slowing price growth. Its consumer price index witnessed a rise of 0.1 per cent on the year in April and is on the verge of negative growth, according to Nikkei Asia report.

Bureau of Statistics spokesperson Fu Linghui said that there is “no deflation in the Chinese economy.” However, the consumer price indexes for the provinces of Jilin, Shanxi, Guizhou, Liaoning, Anhui and Henan and Shanghai witnessed negative growth in April, Nikkei Asia reported citing data from Chinese research company Wind Show.

Unemployment among those aged between 16-24 topped the 20 per cent mark as graduating university students struggle to find jobs. Weak economic fundamentals are affecting long-term interest rates.

The 10-year government bond yield on Tuesday was at 2.69 per cent, witnessing the lowest point since November. It is approaching the 2.35 per cent logged in June 2022, the lowest figure in statistics tracked by Refinitiv, according to Nikkei Asia report. Lower rates imply a weaker yuan.

The Chinese currency weakened past 7 yuan to the dollar on May 17. In a meeting that took place on the following day, the China Foreign Exchange Committee discussed curbing exchange rate volatility. However, the yuan continued to weaken.

Such uncertainties have led the US and other foreign investors to avoid Chinese stocks. The tensions between the US and China over Taiwan and tech company regulation and the risk of economic sanctions contribute to the trend, as per the news report.

Stocks like Alibaba Group Holding and Tencent Holdings have also suffered. US investment in Chinese stocks could reduce even further as recent Chinese restrictions on US chip company Micron Technology sparked fears of escalating tensions. (IANS/ANI)