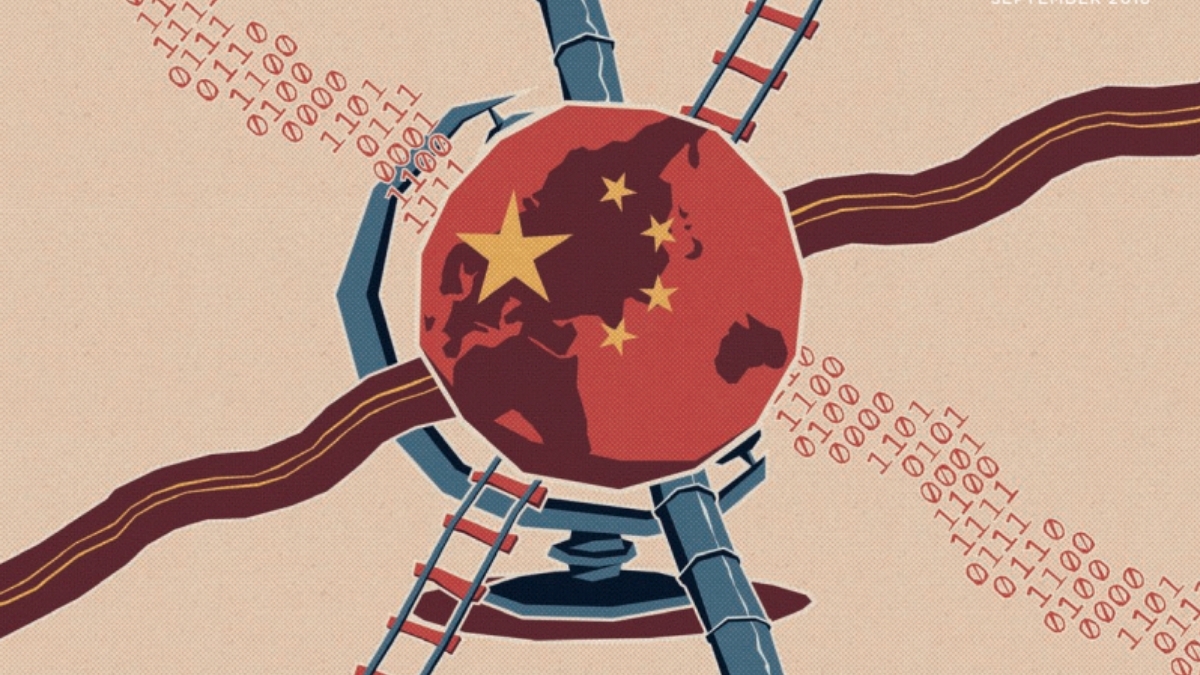

Chinese companies are not losing interest in BRI or overseas investment, but their preferences for engaging with the BRI have changed…reports Asian Lite News

Amid accusations of “debt-trap diplomacy”, Chinese companies seek more overseas direct investment opportunities and fewer foreign contracted projects as President Xi Jinping’s flagship initiative of BRI is stymied by poor risk management, Nadia Clark wrote in a blog for Council for Foreign Relations.

China is now realising the true cost of the BRI, as it is forced to choose between repayment on the hundreds of billions in loans its companies and state banks have issued and whatever goodwill it may have accumulated through this initiative, Clark wrote.

China should be wary lest the BRI follow the path of its ancient predecessor, with fragmentation contributing to decline and eventual collapse.

China’s ascent as an international financier (especially in low-income countries) has been accompanied by claims that it engages in so-called debt-trap diplomacy.

The term originated in 2017 to describe a deal that saw Beijing receive a 99-year lease for the Hambantota Port in Sri Lanka after the country fell behind on debt payments and has since been more widely applied to any Chinese project that conflicts with Western interests, especially those under the Belt and Road Initiative (BRI), Clark said.

Western media and senior policy officials seem to feel that China is using the BRI to exert undue influence over the world, especially because the initiative mostly funds infrastructure rather than the social sector projects, such as health or education initiatives, that are often favoured by large multilateral donors and Western nations.

Critics worry that China will be able to seize control of these assets for military use or use them as leverage in future negotiations, Clark said.

The real reason why the BRI has struggled to sustain itself is not due to debt traps or predatory lending, but something far more mundane: Poor risk management and a lack of attention to detail and cohesion from the Chinese state-owned enterprises and banks, private companies, and local governments involved, Clark added.

Chinese companies are not losing interest in BRI or overseas investment, but their preferences for engaging with the BRI have changed. It is possible that Chinese companies bit off more than they could chew when they began signing BRI foreign contracted projects at the start of the initiative, initially committing to a large volume of projects and leaving little room for participation in new projects in later years.

It could be that they feel less protected or supported without strong government oversight and therefore become more risk averse. It is also possible that less projects are being signed because companies cannot find willing host country partners, Clark wrote.

In recent years, there have been an increasing number of reports from BRI partner countries about construction flaws in major infrastructure projects, project cancelations initiated by BRI partner countries due to concerns over corruption and debt, project cancelations initiated by Chinese companies due to financial problems and projects that have led to nowhere (in some cases, literally – such as a BRI-funded that ends in the middle of a field in Kenya).

All of these factors do not point to malicious or predatory lending, but rather overzealous engagement on the part of both Chinese companies and BRI partners. BRI participants were so eager to see the gains from these projects (whether political, financial, or economic) that they rushed into deals without adequate planning.

Most projects were completed as standalone enterprises, with little thought for the bigger picture of how different pieces of infrastructure need to fit together in order to function effectively.

For example, standalone ports are essentially useless without accompanying roads and railways to transport goods from ships further inland. Such fragmentation has plunged both Chinese companies and BRI partners into billions of dollars of debt and a number of prolonged debt-restructuring deal negotiations, Clark added.

China has developed a system of “Bailouts on the Belt and Road” that helps recipient countries to avoid default, and continue servicing their BRI debts, at least in the short run, a new report has found.

In total, more than 20 debtor countries have received $ 240 billion in Chinese rescue lending since 2000. The scale of China’s global bailout lending program is also growing fast. More than $ 185 billion USD was extended in the past five years alone (2016-2021), as per a report by researchers from the World Bank, Harvard Kennedy School, AidData, and the Kiel Institute for the World Economy.

Thirteen countries made total drawings of $170 billion in situations of economic or financial distress. Examples include Argentina (2014-2021), Mongolia (2012-2021), Suriname (2015-2021), and Sri Lanka (2021), which drew on their RMB swap lines right before and/or after sovereign defaults on their external creditors.

Other important users include Pakistan (2013-2021), Egypt (2016-2021) and Turkey (2021), which made large drawdowns during protracted balance of payments crises, as demonstrated by their crashing currencies in the face of dwindling foreign exchange reserves.

Another group, including Russia (in 2015 and 2016) and Ukraine (in 2015), activated its swap lines in the face of sanctions and deep geopolitical crises.