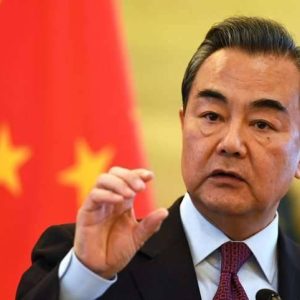

President Ranil Wickremesinghe on Tuesday informed Parliament that the government received a letter of assurance from the Chinese Exim Bank…reports Asian Lite News

Breaking the biggest barrier to receive the promised conditional International Monetary Fund (IMF) bailout package of $2.9 billion to help Sri Lanka’s cash-strapped economy, China has given assurance to help the island nations debt restructuring programme.

President Ranil Wickremesinghe on Tuesday informed Parliament that the government received a letter of assurance from the Chinese Exim Bank on Monday night and the letter of intent signed by the Central Bank Governor and himself was sent to the IMF immediately.

Wickremesinghe, who also the Finance portfolio, assured that once the IMF agreement is reached, the deal would be tabled in Parliament along with the draft of the government’s future plan and road map.

A delay by China the biggest bilateral creditor to the island nation accounting for 52 per cent, had been hampering Sri Lanka’s effort to get the much needed dollar bail out promised by the IMF in last September.

Referring to Sri Lanka’s attempt reach the IMF conditions to get the bailout, in January US Ambassador to Sri Lanka, Julie Chung urged China not to be a spoiler.

“For the sake of the Sri Lankan people, we certainly hope China is not a spoiler as they proceed to attain this IMF agreement,” she complained.

In an interview to the BBC on January the US Ambassador claimed that the greater onus to move with regard to Sri Lanka’s debt restructuring, a prerequisite for an IMF bailout, was on China, as the biggest bilateral lender.

“We hope that they do not delay because Sri Lanka does not have time to delay. They need these assurances immediately,” Ambassador Chung stated.

Accounting for 12 per cent of total debt, India, the third largest bilateral creditor to Sri Lanka after China and Japan, was the first to formally inform the IMF of its assurance for the external debt restructuring programme.

The closest neighbour to the crisis-hit country, India’s outstanding credit to Sri Lanka amounted to nearly $1.7 billion up to June last year.

Following India, in February the Paris Club of creditors announced its supports for the debt restructuring of Sri Lanka.