Prices are rising as companies pass on the cost of tariffs to consumers. Supply chains, fragile after years of disruption, are seizing once again. Economists forecast that if maintained, the tariffs could shrink US GDP by around 6%, depress wages by 5%, and cost the average middle-income household roughly $22,000 over a lifetime … writes Harmeet Singh Ahuja

Now that the dust seems to have started settling on the recent heavy turmoil in financial markets and the business world after the world was shocked by the level of tariff imposed by the Trump administration, it is worth considering why this even had to happen in the first place.

The world is still jittery from pandemic aftershocks and war in Europe, and the Trump administration’s 2025 tariffs have delivered another jolt. Under the sweeping measures, a 25% tariff now applies to imports from Canada and Mexico, while most Chinese goods face a staggering 145% levy. Framed as a battle for national security and economic independence, the tariffs are a sledgehammer that may bruise America’s friends as much as its rivals.

For decades, American trade policy was defined by free trade agreements designed to lower prices and cement geopolitical alliances. But those bargains had costs. Factories shuttered, and jobs were lost. Supply chains stretched thin across oceans and were potentially subject to disruption, as the COVID pandemic and the war in Ukraine showed us.

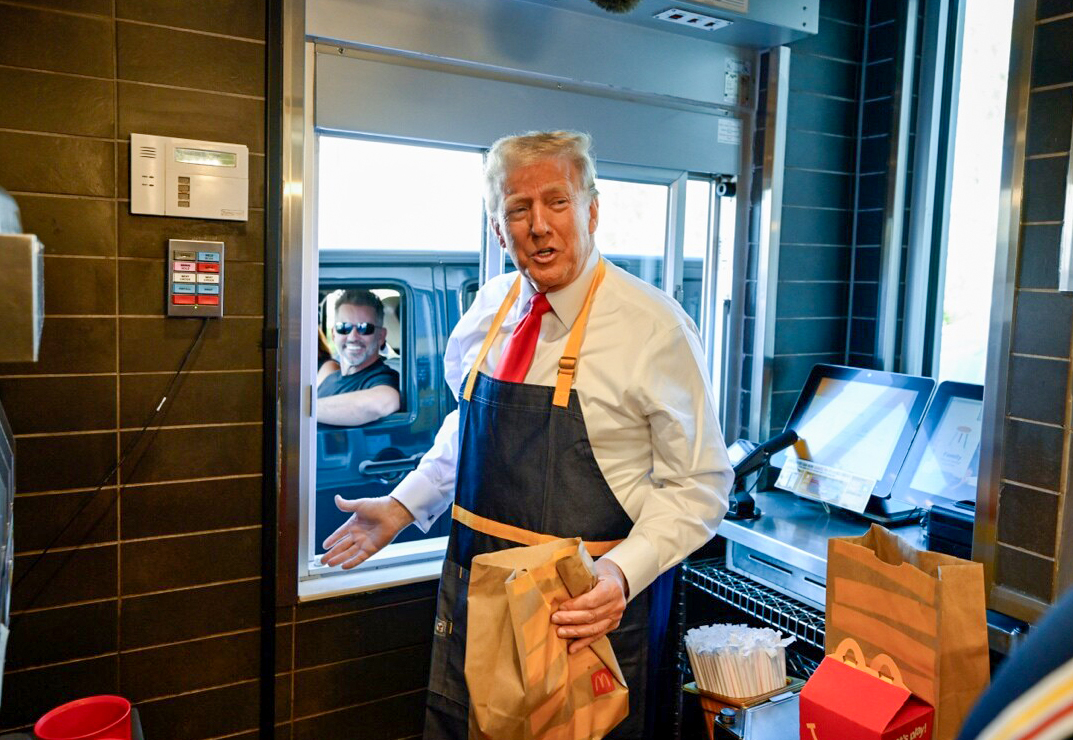

The Trump administration’s tariffs mark a break from this orthodoxy, a raw assertion that national security must trump (excuse the pun) economic efficiency. Few sectors are spared. Only consumer electronics such as smartphones and laptops enjoy temporary exemptions (I imagine there would have been substantial objection from his administration as to why their iPhones and iPads were about to double in price).

Even close allies find themselves in the crosshairs. Canada and Mexico, lynchpins of North America’s integrated economy, have reacted with caution and quiet fury. China has retaliated more forcefully, slapping 125% tariffs on American goods and throttling exports of rare earth elements vital to American manufacturing. The economic fallout is already biting.

Prices are rising as companies pass on the cost of tariffs to consumers. Supply chains, fragile after years of disruption, are seizing once again. Economists forecast that if maintained, the tariffs could shrink US GDP by around 6%, depress wages by 5%, and cost the average middle-income household roughly $22,000 over a lifetime. Few policies have imposed a heavy burden so quickly; even a sweeping corporate tax rise would have been gentler.

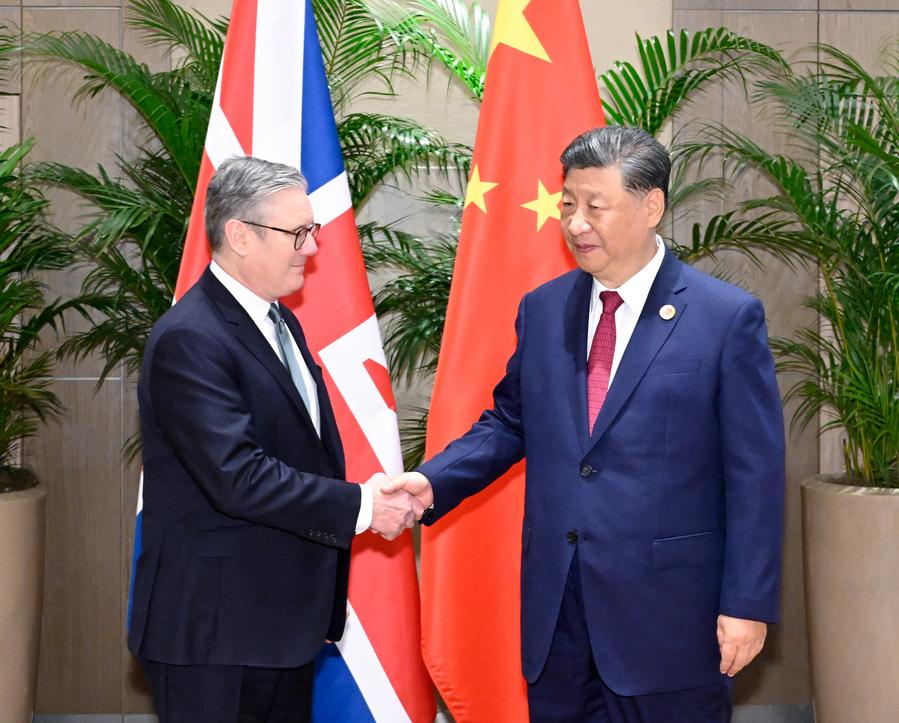

Beyond the dollars and cents, the strategic calculus is murkier still. Some adjustments in tariffs aimed at China would be understandable, but they would be too blunt and needed diplomacy and good communication, both sadly lacking. However, dragging Canada and Mexico into the fray risks damaging the alliances America needs to counter China’s growing influence. Sensing the new volatility, other countries are hedging their bets—striking regional trade pacts and reducing their reliance on the American market. For a country whose economic power has long been a key pillar of its global might, this drift carries risks that tariffs alone cannot fix. There are signs of second thoughts. Treasury Secretary Scott Bessent has floated the idea of lowering tariffs on Chinese goods to between 50% and 65%, a nod to the pain the measures are causing at home.

But for now, America barrels forward—picking a trade fight with rivals and the world. I think the Americans will retract most of their tariffs and do what they should have done in the first place: look at specific sectors where there is an imbalance in “fairness” of the tariff structure and negotiate it quickly so that American consumers are not hurt and the same for business everywhere. This would have helped the US raise some extra revenue from tariff income, which could have been used to lower consumer income tax. But their approach has been that of a sledgehammer when a chisel was needed. However, I fear the current approach will lead to a less prosperous, less trusted, and ultimately less powerful America.