The Bank of England has managed to get inflation down from a four-decade high of more than 11%, by raising its main interest rate aggressively from near zero to 5.25% from late 2022 until August last year…reports Asian Lite News

Inflation in the UK held steady at 4% in January as lower food prices helped offset an increase in energy costs, official figures showed Wednesday.

The reading was better than expected as most economists expected inflation to rise modestly to around 4.2%.

The Office for National Statistics said the main downward contribution to the figure was a monthly drop in food prices of 0.4%, which was the first since September 2021.

“This is welcome news for low-income households who spend a higher proportion of their income on food,” said Lalitha Try, economist at the Resolution Foundation think tank.

Though interest rates appear to have peaked, the Bank of England has expressed caution about cutting interest rates too soon as lower borrowing rates may bolster spending and put renewed upward pressure on prices.

The Bank of England has managed to get inflation down from a four-decade high of more than 11%, by raising its main interest rate aggressively from near zero to 5.25% from late 2022 until August last year.

Borrowers will be hoping the next move is to lower the rate and soon. But the bank’s last set of forecasts showed inflation remaining above the target for much of this year and next and wage growth — a key driver of prices — running too high for comfort.

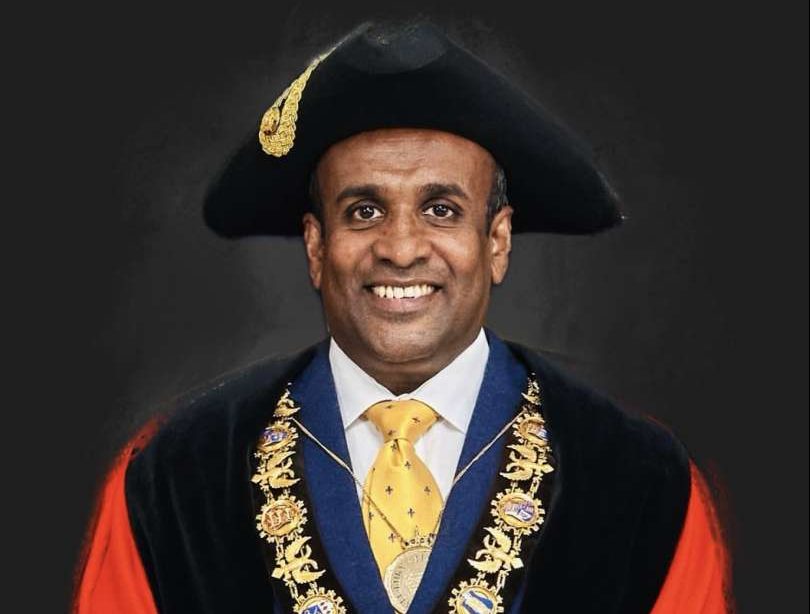

Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, said the journey back to the target “should now accelerate,” with a sizeable fall in energy bills from April and lower food costs likely.

“While interest rates could start falling over the summer, large tax cuts in next month’s budget would risk pushing the Bank of England to keep policy tighter for longer by refueling concerns over inflation,” he said.

High inflation was first stoked by supply chain issues during the coronavirus pandemic and then Russia’s full-scale invasion of Ukraine, which pushed up food and energy costs.

While the interest rate increases have helped in the battle against inflation, the squeeze on consumer spending, primarily through higher mortgage rates, has weighed on the British economy, which has barely grown over the past year.

Figures on Thursday could show that it slipped into recession, albeit a modest one, at the end of 2023 — officially defined as two straight quarters of negative growth.

Bank of England Governor Andrew Bailey told a parliamentary committee on Wednesday that a recession, if confirmed, would likely be brief.

“Going forward, and I think this is in some ways more significant, we are now seeing some signs of the beginning of a pick-up in some of the surveys, for instance,” he said.

Whatever materializes in Thursday’s figures, few expect growth to be hugely material in the run-up to the general election in the coming year. That’s a concern for the governing Conservative Party, which opinion polls say is way behind the main opposition Labour Party ahead of the vote, the date of which will be determined by British Prime Minister Rishi Sunak.