Industry experts predict India’s chip design prowess will expand into fabrication, intensifying competition with China…reports Asian Lite News

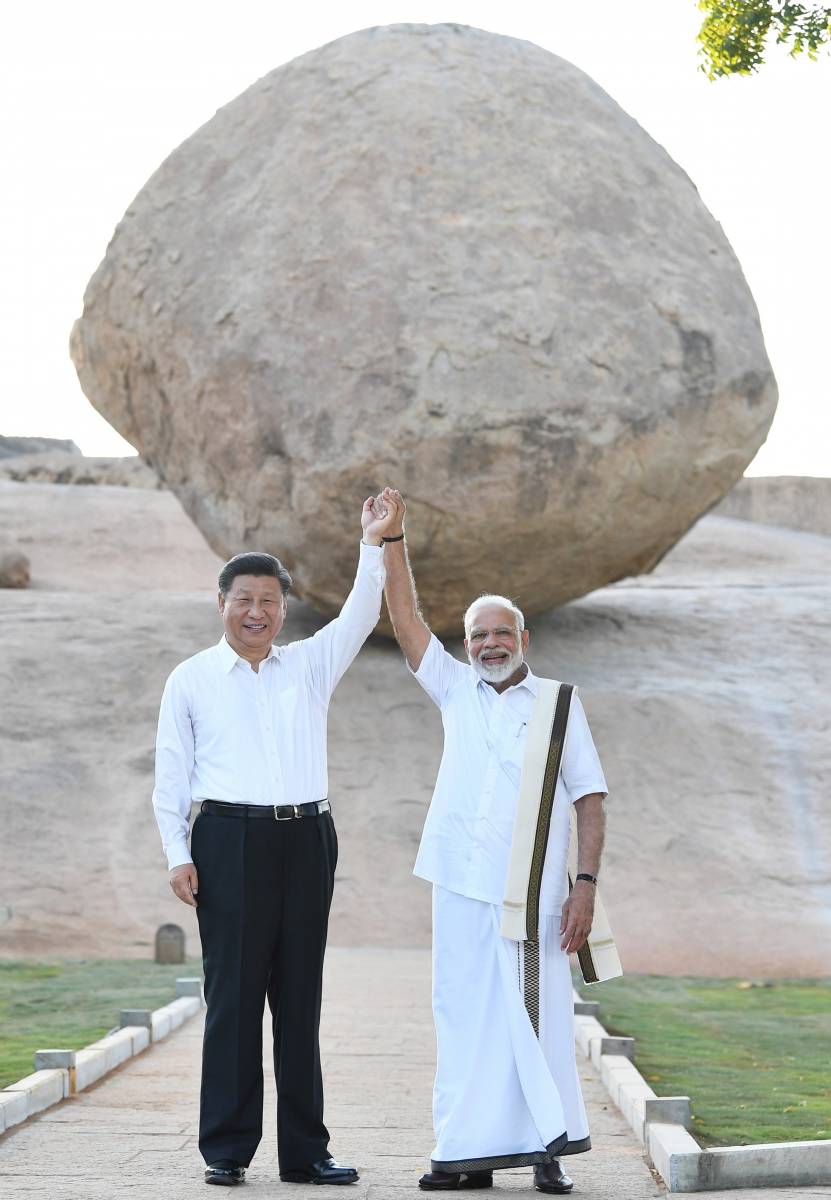

As India embarks on its ambitious semiconductor journey with a likely groundbreaking ceremony of three new semiconductor projects worth $15.14 billion, including two from the Tata Group, next week, the bold initiative under Prime Minister Narendra Modi’s leadership has started to jolt China’s dominance in the global silicon market.

The groundbreaking for three chip plants is likely happening in less than two weeks after the Union Cabinet, chaired by PM Modi, approved the establishment of these units that are set to generate direct employment of 20,000 advanced technology jobs and nearly 60,000 indirect jobs.

The new units, including Tata’s fab with Taiwan’s Powerchip Semiconductor Manufacturing Corp (PSMC) in Dholera, Gujarat targeting 50,000 wafers per month for high-performance chips; Tata’s assembly, testing, monitoring, and packing (ATMP) unit in Assam for advanced packaging technologies; and CG Power’s Gujarat unit with Renesas Electronics and Stars Microelectronics, mark India’s commitment to building a strong semiconductor ecosystem through substantial investments and global partnerships.

India already has deep capabilities in chip design. With these units, the country will develop capabilities in chip fabrication too, thus further challenging China’s market share in the coming years, say industry experts.

According to a latest Moody’s Analytics report, new investments in the semiconductor industry seem to be moving away from China and electronics production will “continue to remain in Asia for the foreseeable future”.

“The global semiconductor shortage, influenced by the pandemic, led tech companies in various fields — from manufacturing to design — to seriously consider diversification strategies like the ‘China plus one other nation’ approach. Capitalising on this, the Indian government provided significant incentives and solid policies for these tech firms,” Neil Shah, Vice President, Research at market intelligence firm Counterpoint, told IANS.

This strategic move is aimed at establishing a thriving semiconductor ecosystem in the country.

“Given India’s existing reputation as a centre for cutting-edge research, a robust software industry, and a wealth of English-speaking talent, the choice for tech companies to invest in India becomes an obvious and attractive one,” Shah added.

Additionally, some conglomerates saw this as an opportunity to enhance vertical integration and join the competition.

The first India-made chip from the Rs 22,500 crore Micron semiconductor plant in Gujarat is set to arrive in December this year.

Other than the Micron plant, Tata’s semiconductor fab with Taiwan’s PSMC will be constructed with an investment of Rs 91,000 crore. This fab will cover high-performance compute chips with 28 nm technology, and power management chips for electric vehicles (EVs), telecom, defence, automotive, consumer electronics, display, power electronics, etc.

The chip assembly, testing, monitoring, and packing (ATMP) unit with a capacity of 48 million per day by Tata Semiconductor Assembly and Test Pvt Ltd (TSAT) in Morigaon, Assam, will be set up with an investment of Rs 27,000 crore.

The third semiconductor ATMP unit for specialised chips will be set up by CG Power, in partnership with Renesas Electronics Corporation, Japan and Stars Microelectronics, Thailand in Sanand, Gujarat, with a capacity of 15 million per day and an investment of Rs 7,600 crore.

“Together, we are on a journey to firmly position Bharat on the global semiconductor map, fuelled by our unwavering commitment,” said Pankaj Mohindroo, Chairman of India Cellular and Electronics Association (ICEA).

The setting up of new chip units will catalyse job creation across the automotive, electronics, telecom, and industrial manufacturing sectors, accelerating employment opportunities in industries dependent on semiconductor technologies.

Lt Gen Dr SP Kochhar, Director General, Cellular Operators Association of India (COAI), said that with the output from these new units being poised to benefit various sectors and segments, “it is expected to provide a fillip to the ‘Digital India’ mission through increased technological prowess and advancement of the indigenous industrial ecosystem, besides generating employment and attracting more investments in the country”.

India is already a dominant force in the global electronics manufacturing supply chain, led by mobiles. The nation has become the second-largest manufacturer of mobile phones in the world (in volume terms).

According to latest government figures, “The export of mobile phones has also increased from an estimated Rs 1,566 crore in 2014-15 to an estimated Rs 90,000 crore in 2022-23, making an impressive increase in exports by more than 5,600 per cent.”

After the success of the Production Linked Incentive (PLI) scheme for mobile phones, the government is expecting that PLI for IT hardware and servers will lead to expanding the investments in the component ecosystem in the country to develop the supply chain.

“Verticals other than mobile phones will also come into their own, like IT hardware manufacturing which is expected to cross $15 billion by 2029,” said Mohindroo.

The government’s strategy to reach the $300 billion level in production of electronics from the current level of about $75 billion is built on broadening and deepening electronics manufacturing in the country, according to industry bodies.

ALSO READ: Middle East’s Aircraft Service Market Set to Skyrocket