Going forward, Vedanta Aluminium will move from 100 per cent domestic captive bauxite to 100 per cent domestic captive alumina and coal which, in turn, would cut the production cost to close to $600 to $1,000/ton…reports Venkatachari Jagannathan

The demerger of Anil Agarwal’s Vedanta Ltd into six companies has got the green signal from the bourses while discussions with the lenders on the division of the debt with the demerged entities are on.

The name of the company that would house the company’s aluminium business has also been finalised, said a top official of the aluminium business vertical.

Vedanta Aluminium is also working towards cutting down its production cost to about $600-$1,000 per ton through various means over a period.

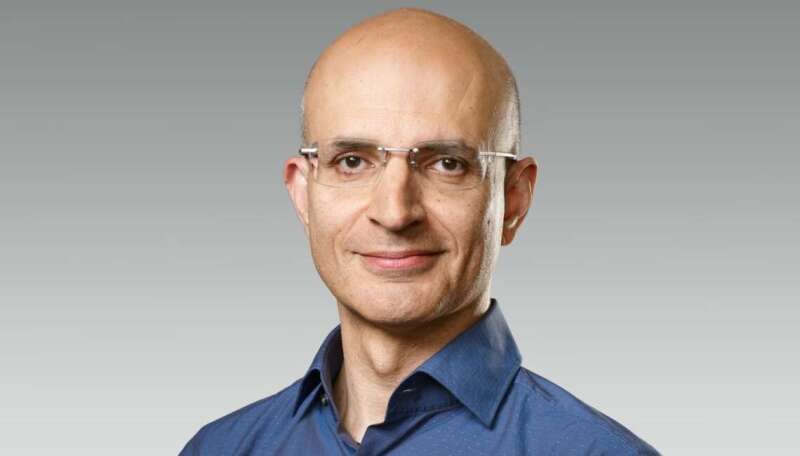

“We have already got the non-objection certificate from the stock exchanges – the BSE and NSE. Once we get the lender’s no-objection certificate, we would expect SEBI (Securities and Exchange Board of India) to provide their no-objection certificate. And then, the scheme gets submitted to the NCLT (National Company Law Tribunal) for sanction. So, our expectation is that the demerger will happen towards the end of the calendar year 2024 or Q3 of FY25,” John Slaven, CEO of Vedanta Aluminium (now part of Vedanta Ltd) told IANS in an exclusive interview dwelling on global and domestic demand and price trends and expansion plans.

On the name for the demerged company under which the aluminium business will be housed, Slaven said: “Vedanta Aluminium Metal Ltd. Each one of the companies will have their own names. But, we still remain very closely affiliated with Vedanta. Vedanta Resources will still own the majority of the company. Currently, Vedanta Resources owns about 62 per cent of Vedanta Ltd. and at the time of demerger, they will continue to have 62 per cent odd ownership of the aluminium business. All the aluminium interests that Vedanta has will be part of Vedanta Aluminium Metal including the 51 per cent stake in BALCO (Bharat Aluminium Company Ltd).”

On the share of Vedanta Ltd debt for Vedanta Aluminium Metal, Slaven said: “That is still being worked through with our corporate treasury/corporate finance team, and also in consultation with the banks. There are some very clear guidelines in terms of how the debt is allocated under the code. So, we will be following that. So, at this stage, I do not have a specific figure that I could share with you.”

Vedanta Aluminium is working towards cutting down the metal production cost to between $600-$1,000 per ton over time.

From a production cost of $2,653/ton in Q1FY23, the company has brought down the cost to $1,735/ton and is targeting to lower it further to $1,550/ton in the near term.

About the steps taken to cut the production cost, Slaven said: “In a commodity business, that is exceptional. We have been pushing incredibly hard to drive operational efficiency. So, that is really squeezing the assets. Getting more volume out of the same capacity enables us to reduce costs. We are also focusing on our own efficiency in raw material consumption. We have increased production volume by about 465 tonnes per annum over the past four years sans much of capital.”

With coal being a major cost factor, Vedanta Aluminium worked to increase the amount of linkage coal in production and did e-auctions to get coal at a competitive rate. On the logistics side, the division worked closely with Indian Railways to increase the utilisation of racks and reduce the turnaround time to improve racks’ loading. So, that increases the flow which in turn reduces the cost of transporting coal by road.

“We have also been working to improve the output out of our captive power plants, making sure that we generate our power versus supplementing that purchase from the grid. So, those are the biggest cost drivers,” Slaven said.

Going forward, Vedanta Aluminium will move from 100 per cent domestic captive bauxite to 100 per cent domestic captive alumina and coal which, in turn, would cut the production cost to close to $600 to $1,000/ton, Slaven said.

According to him, Vedanta Aluminium, which is now ranked third or fourth in the world in terms of capacity, will move up to second or third position post-expansion.

The expansion plans include aluminium from 2.3 million tons per annum (MTPA) now to 2.8 MTPA by FY26, and exploring the feasibility of 3 million tonnes in the medium term; Alumina (Lanjigarh refinery in Odisha) from 2 MTPA to 5 MTPA commissioning by 2QFY25 and full ramp up by end of FY 2025 (further progressing a debottlenecking project which would take overall capacity from 5MTPA to 6MTPA once completed); and captive bauxite mine (Sijimali) to begin initial production in Q3 FY’25, reach rated capacity expansion to 9 MTPA and then further to 12 MTPA, among others.

About the demand and price trend, Slaven said as the world transitions to a zero-carbon world, aluminium is the metal of choice. It has applications in all renewable energies, whether solar, wind, energy transmission, lightweight vehicles, or packaging and all these are leading to an increase in demand.

“Since 2015, globally, the demand has grown at about 2.4 per cent per year. We are expecting that between now and the end of the decade, that increase will be about 3.3 per cent. This is driven by carbon emission reduction. So, this is a very positive development for the industry. It already consumes large quantities today. We are consuming about 100 million tonnes of aluminium and if it continues at 3 per cent, we see a very positive picture there,” he said.

According to him, in India, over the past three years, the demand growth is about 14 per cent on average and this year, it is 16 per cent, and might close the fiscal with a 17 per cent increase.

The demand in India is about five million tonnes and domestically produced aluminium is about 2 million tonnes. So, about 60 per cent of the metal units consumed are imported. Scrap imports account for 1.9 million tonnes and the balance is imported in the form of downstream products. India’s per capita demand at the moment is 3 kg. The global average is about 12 kg. In China, it is about 30 kg/capita/year. So, we are 10 per cent of the Chinese demand on a per capita basis. With the Indian economy in the growth cycle, the metal demand will be high from infrastructure building and other sectors. And, hence the demand will be high for several years to come, unlike the advanced economies.”

“As regards the price trend, in the medium to long-term pricing will be really positive based on China capping its production capacity at 45 million tons and the continued strong demand. In the short term, in 3-6 months, it will continue to move in the current range of $2,250-$2,300/ton. If the US and Europe impose sanctions on Russian aluminium now being sold into LME, then there will be a price increase. Further, the ending of the conflict between Russia-Ukraine and the easing of the interest rates in the US is positive for the global economic activity which in turn would drive the demand for metals,” Slaven said.

Meanwhile, Vedanta Aluminium’s e-superstore Metal Bazaar – the industry’s first of its kind – selling over 750 products is getting a positive reception from the customers, he said.

“Pretty much all the orders now go through the site. We have migrated all the activity with existing customers onto the site. So, there is no parallel process,” he remarked.

The online store enables the customers to manage the complete life cycle.

“I can identify which products they need, understanding the price dynamics. We have got an AI (artificial intelligence) engine to understand how we can do the pricing negotiation, contracting with various subcontractors, long-term contracts, order placement, and tracking the order all the way through to monitoring the delivery,” Slaven added.

ALSO READ-UAE Residents Predict Electric and Hybrid Vehicle Takeover in Coming Years