Paytm offers acquiring services to merchants in partnership with several leading banks in the country and will continue to expand third-party bank partnerships….reports Asian Lite News

Paytm merchants need not worry following Reserve Bank of India’s (RBI) direction to its associate bank as Paytm Soundbox, QR, EDC machines will keep working as usual, and merchants will still be able to accept payments.

Paytm offers acquiring services to merchants in partnership with several leading banks in the country and will continue to expand third-party bank partnerships.

“Paytm’s offline merchants network offering and device business like Paytm Soundbox, EDC, QR will remain unimpacted by the Reserve Bank of India’s (RBI) direction to its associate bank,” said the fintech company, adding that it will also continue onboarding merchants to its platform.

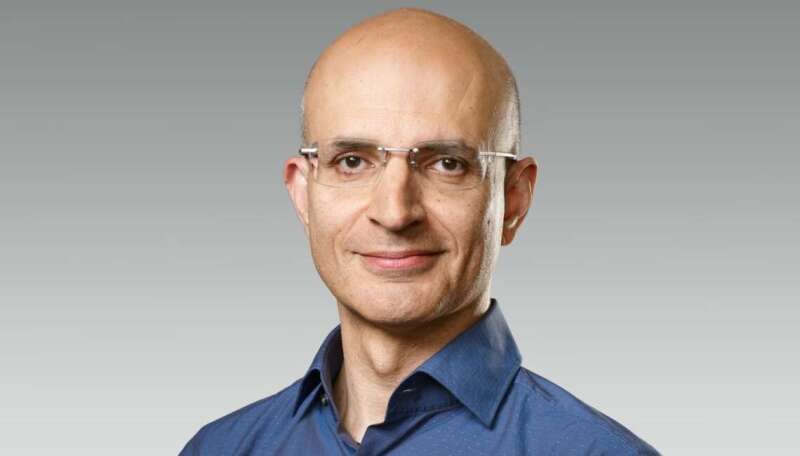

During a conference call on RBI directives to Paytm’s associate bank, Bhavesh Gupta, President and COO, said, “We will ensure the least amount of disturbance to merchants. We will do whatever is the right approach in this matter.”

The company also noted that its Paytm Payment Gateway business (online merchants) will continue to offer payment solutions to its existing merchants.

“There will be no disruption in PG business and it will operate like earlier, now we offer merchants several other options, which is a very quick process,” Gupta added.

Paytm’s offline merchant payment network offerings like Paytm QR, Paytm Soundbox, Paytm Card Machine will continue as usual, where it can onboard new offline merchants as well. For its existing online merchants, Paytm Payment Gateway business will continue to offer payment solutions.

Meanwhile, Paytm clarified that PPBL is run independently by its management and board.

“We would take this opportunity to clarify that as per banking regulations, Paytm Payments Bank Limited is run independently by its management and board. While OCL is allowed to have two board seats on the board of Paytm Payments Bank Limited, as a part of its shareholder agreement, OCL exerts no influence on the operations of Paytm Payments Bank Limited, other than as a minority board member, and minority shareholder,” Paytm said in an exchange filing.

‘App to Remain Functional’

Paytm’s associate Bank recently received the Reserve Bank of India’s (RBI) directions in response to which Paytm’s Founder and CEO Vijay Shekhar Sharma assured users that Paytm app will continue to work beyond February 29.

In a tweet, Vijay Shekhar Sharma said: “To every Paytmer, Your favourite app is working, will keep working beyond 29 February as usual. I, with every Paytm team member, salute you for your relentless support.

In his tweet, he also added, “For every challenge, there is a solution and we are sincerely committed to serve our nation in full compliance. India will keep winning global accolades in payment innovation and inclusion in financial services – with PaytmKaro as the biggest champion of it.”

Following the RBI’s directive, Paytm customers need not to worry as it has said that the app is up and running.

Paytm and its services continue to remain operational beyond 29th Feb, as most of the services offered by Paytm are in partnership with various banks (not just associate Bank).

Paytm has been informed that this does not impact user deposits in their savings accounts, Wallets, FASTags, and NCMC accounts, where they can continue to use the existing balances.

The recent RBI directives on Paytm’s associate bank won’t affect Paytm Money Ltd’s (PML) operations or customers’ investments in Equity, Mutual Funds, or NPS.

Paytm’s other financial services such as loan distribution, and insurance distribution are not in any way related to its associate Bank and will continue to work as usual.

Paytm’s offline merchant payment network offerings like Paytm QR, Paytm Soundbox, Paytm Card Machine, will continue as usual, where it can onboard new offline merchants as well.

Mobile recharges, subscriptions and other recurring payments on the Paytm app will continue to operate smoothly.

ALSO READ: Lulu Signs MoU With UAE Military Veterans