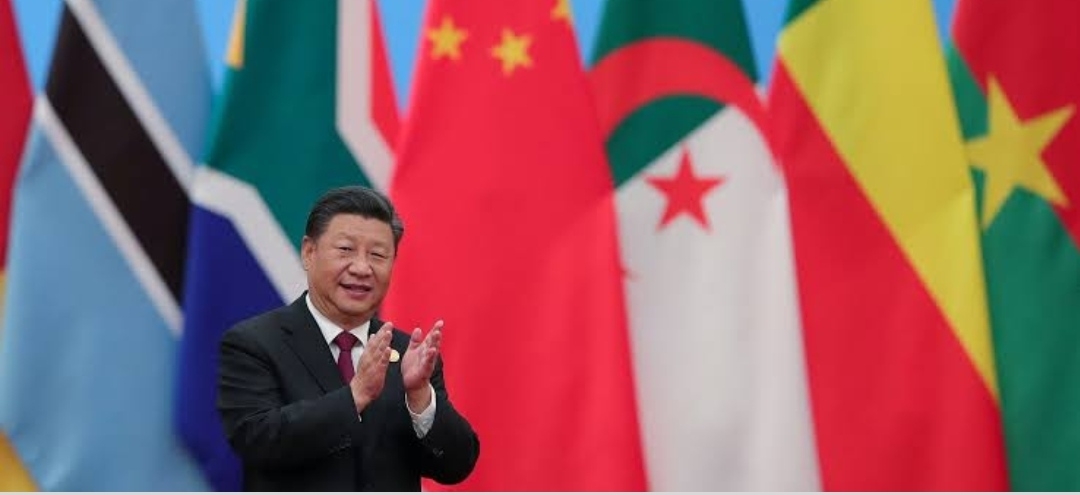

According to analysts, this adds to the pressure on the government to stimulate demand in the world’s second-largest economy….reports Asian Lite News

China’s economy has slipped into deflation as consumer prices declined in July for the first time in more than two years, the media reported.

The official consumer price index, a measure of inflation, fell by 0.3 per cent last month from a year earlier, reports the BBC.

Analysts said this increases pressure on the government to revive demand in the world’s second largest economy.

This follows weak import and export data, which raised questions about the pace of China’s post-pandemic recovery, the BBC reported.

The country is also tackling ballooning local government debt and challenges in the housing market.

Youth unemployment, which is at a record high, is also being closely watched as a record 11.58 million university graduates are expected to enter the Chinese job market this year.

Falling prices makes it harder for China to lower its debt – and all the challenges which stem from that, such as a slower rate of growth, analysts said, the BBC reported.

“There is no secret sauce that could be applied to lift inflation,” says Daniel Murray from investment firm EFG Asset Management.

He suggested a “simple mix of more government spending and lower taxes alongside easier monetary policy”.

Most developed countries saw a boom in consumer spending after pandemic restrictions ended. People who had saved money were suddenly able and willing to spend, while businesses struggled to keep up with the demand.

The huge increase in demand for goods that were limited in supply — coupled with rising energy costs after Russia’s invasion of Ukraine — inflated prices.

But this is not what happened in China, where prices did not soar as the economy emerged from the world’s tightest coronavirus rules. Consumer prices last fell in February 2021, the BBC reported.

In fact, they have been at the cusp of deflation for months, flatlining earlier this year due to weak demand. The prices charged by China’s manufacturers — known as factory gate prices — have also been falling.

“It is worrisome as far as it shows that demand in China is poor while the rest of the world is awakening, especially the West,” Alicia Garcia-Herrero, an adjunct professor at the Hong Kong University of Science and Technology, said.

“Deflation will not help China. Debt will become more heavy. All of this is not good news,” she added.