Some analysts see the Belt and Road Initiative as an unsettling extension of China’s rising power, and as the costs of many of the projects have skyrocketed, opposition has grown in some countries, a report by Sanjeev Sharma

The Belt and Road Initiative is a massive China-led infrastructure project that aims to stretch around the globe.

Some analysts see the project as a disturbing expansion of Chinese power, and the United States has struggled to offer a competing vision, as per an article in the Council on Foreign Relations.

The initiative has stoked opposition in some Belt and Road countries that have experienced debt crises, the article said.

China’s Belt and Road Initiative (BRI), sometimes referred to as the New Silk Road, is one of the most ambitious infrastructure projects ever conceived.

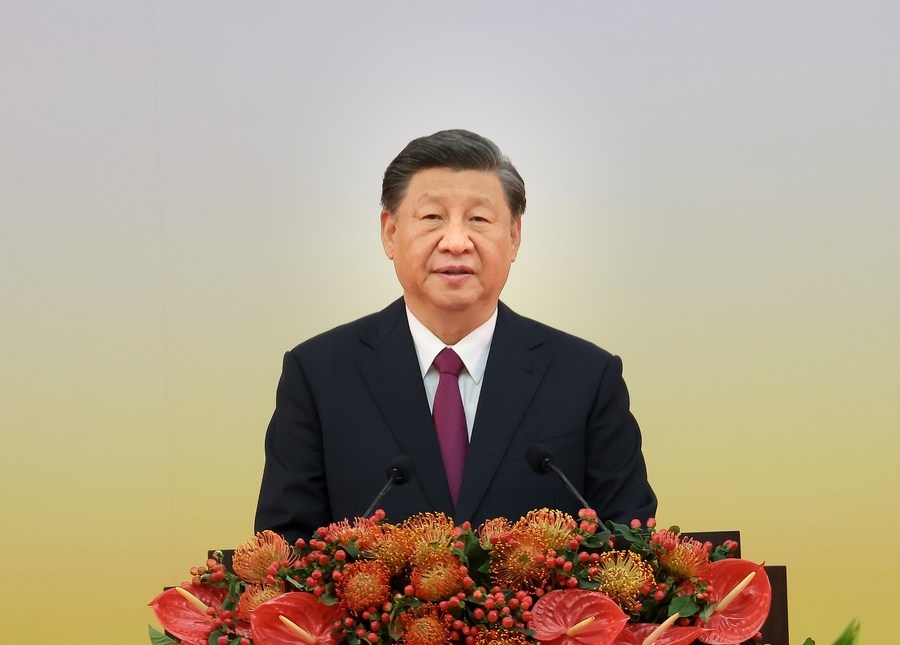

Launched in 2013 by President Xi Jinping, the vast collection of development and investment initiatives was originally devised to link East Asia and Europe through physical infrastructure. In the decade since, the project has expanded to Africa, Oceania, and Latin America, significantly broadening China’s economic and political influence.

Some analysts see the project as an unsettling extension of China’s rising power, and as the costs of many of the projects have skyrocketed, opposition has grown in some countries.

Meanwhile, the United States shares the concern of some in Asia that the BRI could be a Trojan horse for China-led regional development and military expansion, the article in the Council on Foreign Relations said.

To date, 147 countries — accounting for two-thirds of the world’s population and 40 per cent of global GDP — have signed on to projects or indicated an interest in doing so, it added.

China has both geopolitical and economic motivations behind the initiative. Xi Jinping has promoted a vision of a more assertive China, even as the country’s outstanding loans have grown to the equivalent of over a quarter of its GDP, the article said.

“China has had a fair amount of success in redrawing trade maps around the world, in ways that put China at the centre and not the U.S. or Europe,” says CFR’s David Sacks, an expert on U.S.-China relations.

The Belt and Road Initiative has also stoked opposition. For some countries that take on large amounts of debt to fund infrastructure upgrades, the BRI money is seen as a potential poisoned chalice, the article said.

Examples of such criticisms abound. In Malaysia, former prime minister Mahathir bin Mohamad campaigned against overpriced BRI initiatives and cancelled $22 billion worth of BRI projects, although he later announced his “full support” for the initiative. CFR’s Belt and Road Tracker shows overall debt to China has soared since 2013, surpassing 20 percent of GDP in some countries.

Since the COVID-19 pandemic and the Russian invasion of Ukraine roiled global markets, a climbing number of low-income BRI countries have struggled to repay loans associated with the initiative, spurring a wave of debt crises and new criticism for BRI.

In Pakistan, for example, imports required to build CPEC infrastructure contributed to a widening budget deficit, ultimately resulting in a bailout from the IMF. And in Ghana and Zambia, high debt loads that partly consisted of BRI loans led to sovereign default. However, many countries that sign on to BRI have few alternatives, Sacks says.

During the past decade, China handed out a trillion dollars in international loans as part of Beijing’s Belt and Road initiative, intended to develop economic trade and expand China’s influence across Asia, Africa and Latin America, Wall Street Journal reported.

Those loans made Beijing the largest government lender to the developing world by far, with its loans totalling nearly as much as those of all other governments combined, according to the World Bank.

Yet China’s lending practices have been criticised by foreign leaders, economists and others, who say the program has contributed to debt crises in places like Sri Lanka and Zambia, and that many countries have limited ways to repay the loans.

Some projects have also been called mismatches for a country’s infrastructure needs or damaging to the environment, Wall Street Journal reported.

Now, low-quality construction on some of the projects risks crippling key infrastructure and saddling nations with even more costs for years to come as they try to remedy problems.

“We are suffering today because of the bad quality of equipment and parts” in Chinese-built projects, said Ren Ortiz, Ecuador’s former energy minister and ex-secretary general of the Organization of the Petroleum Exporting Countries.

Built near a spewing volcano, it was the biggest infrastructure project ever in this country, a concrete colossus bankrolled by Chinese cash and so important to Beijing that China’s leader, Xi Jinping, spoke at the 2016 inauguration.

Today, thousands of cracks have emerged in the $2.7 billion Coca Codo Sinclair hydroelectric plant, government engineers said, raising concerns that Ecuador’s biggest source of power could break down. At the same time, the Coca River’s mountainous slopes are eroding, threatening to damage the dam, Wall Street Journal reported.

It is one of many Chinese-financed projects around the world plagued with construction flaws.

Chinese money has been used to build everything from a port in Pakistan to roads in Ethiopia and a transmission line in Brazil.

Chinese construction companies often bid for government projects or directly approach local officials with projects with a promise that they can easily arrange financing packages from Chinese banks and insurers, Wall Street Journal reported.

That, developing-country officials say, has given Chinese companies a leg up, because it means governments eager to build a new dam or road don’t have to drum up their own funding. In Africa, more than 60 per cent of the revenue major international contractors collected in 2019 went to Chinese companies, according to a 2021 paper by the China-Africa Research Initiative at Johns Hopkins University.

Critics say the relatively easy availability of Chinese loans for Chinese construction can lead to inflated project costs because there is less pressure on governments to minimize expenses.

Flaws in some of the Chinese-built projects have come to light, Wall Street Journal reported.

In Pakistan, officials shut down the Neelum-Jhelum hydroelectric plant last year after detecting cracks in a tunnel that transports water through a mountain to drive a turbine.

The head of the country’s electricity regulator, Tauseef Farooqui, told Pakistan’s senate in November that he was concerned the tunnel could collapse just four years after the 969-megawatt plant became operational. That would be disastrous for a nation that has been battered by rising energy prices, said Farooqui.

The closure of the plant has already cost Pakistan about $44 million a month in higher power costs since July, according to the regulator, Wall Street Journal reported.

ALSO READ-China plans to triple nuclear warheads to 900 by 2035