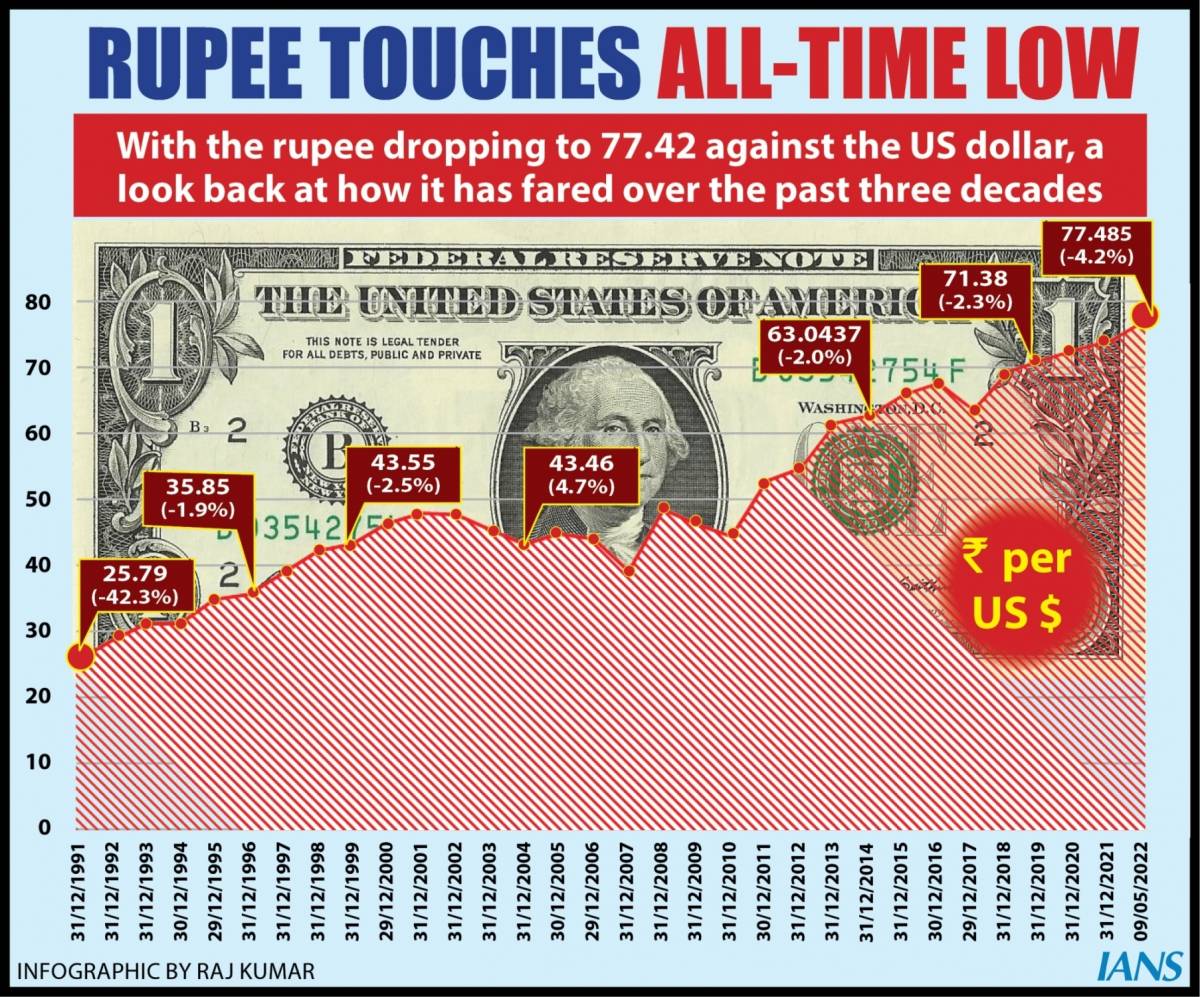

He said the Rs 79.25 mark will act as resistance for rupee and break above Rs 79.25 will trigger short covering for rupee…reports Asian Lite News

The Indian rupee will trade between Rs 79.50-Rs 80.50 against the US dollar next week, a senior official of LKP Securities said on Friday.

On Friday during the early trade, the Indian rupee gained seven paise to touch Rs 79.92 for a dollar.

According to Jateen Trivedi, Vice President, Research Analyst at LKP Securities, the rupee range can be seen between 79.50-80.50 for the coming week.

“Rupee traded in a range between 79.80 and 79.98. As dollar index traded in a range, broadly the trend for dollar is positive till the time it is above $105… next hurdle for dollar can be seen around $110, hence rupee can be seen weak… the trend continues towards 80.50,” Trivedi said.

He said the Rs 79.25 mark will act as resistance for rupee and break above Rs 79.25 will trigger short covering for rupee.

ALSO READ-‘Nothing’ under fire in India