The finance minister also recommended looking out for diversification, expansion, and exploring new opportunities that can keep them afloat in the market…reports Asian Lite News

Union Finance Minister Nirmala Sitharaman on Thursday said the Public Sector Enterprises (PSE) in the strategic core sector need to scale-up their performances and if required should enter into a partnership with the private sector to survive.

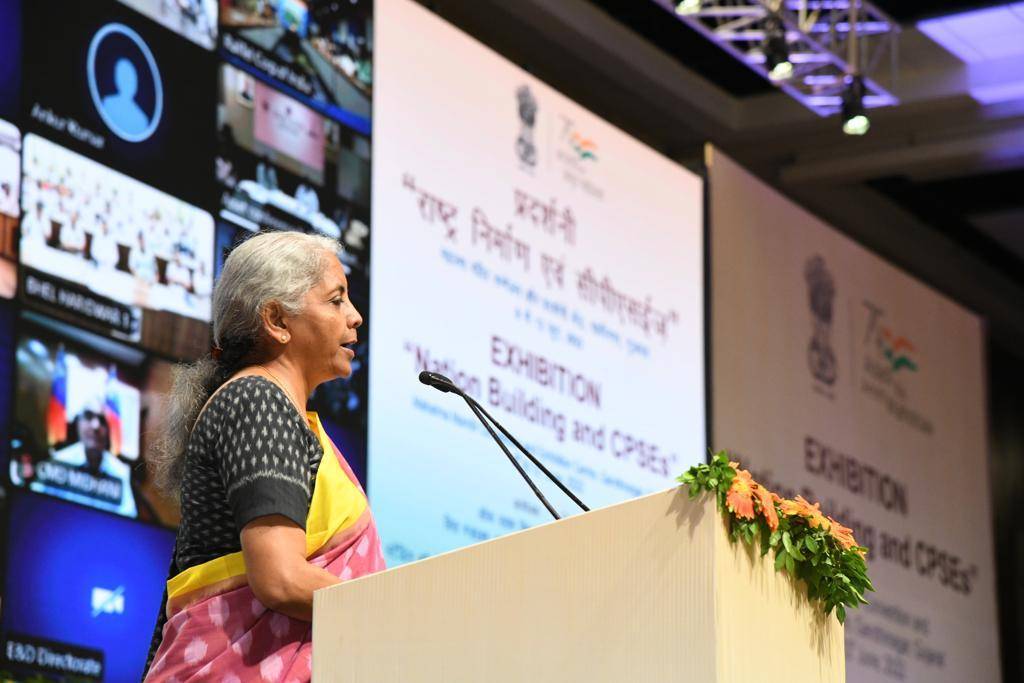

She was in Gandhinagar to inaugurate ‘Nation Building and CPSE’s Exhibition’.

Addressing the event, she said, “In the competitive world, even Public Sector Enterprises (PSE) in the strategic core sector have to scale up their skills, capacities, competence, efficiency and if required should enter into partnership with the private sector to survive.

“In 2021, the Central government decided to minimise the public sector role in nation building. So many sectors were opened for private sectors. Those that are still reserved for PSE, even in these sectors the role is going to reduce soon.”

She added, “It is high time for the PSEs to prove their strength and competency. If it is not expanded at the right time, it will be difficult for them to survive, or their presence may go unnoticed.”

The finance minister also recommended looking out for diversification, expansion, and exploring new opportunities that can keep them afloat in the market.

“When the country was freed from colonial rule, the nation needed to be self-reliant. For that the government made public investment in many sectors. Even though several sectors were reserved for PSUs (PSEs), post-liberalisation and globalisation, many sectors were opened for the private sector. Till 2021, some PSEs enjoyed this protection, now their roles will be minimised. Their role and contribution in nation building is noteworthy,” said Nirmala Sitharaman.

Meanwhile, after reports emerged of a teenage Covid orphan being troubled by loan agents for the repayment of outstanding debt left behind by her late father, Union Finance Minister Nirmala Sitharaman intervened and asked officials to take up the case.

The finance minister has asked the Department of Financial Services and Life Insurance Corporation to look into the matter.

“Please look into this. Also brief on the current status,” Sitharaman tweeted while attaching the news report titled “Orphaned Topper Faces Loan Recovery Notices” with it.

The father of 17-year-old Vanisha Pathak from Bhopal was an LIC agent and had taken a loan from his office.

Since Vanisha is a minor, LIC has blocked all her father’s savings and the commissions he would get every month, as per the report. Her father died during the second wave of Covid in 2021. She had reportedly received the last legal notice on February 2, 2022, to repay Rs 29 lakh, or else would be subjected to legal consequences, the report said.