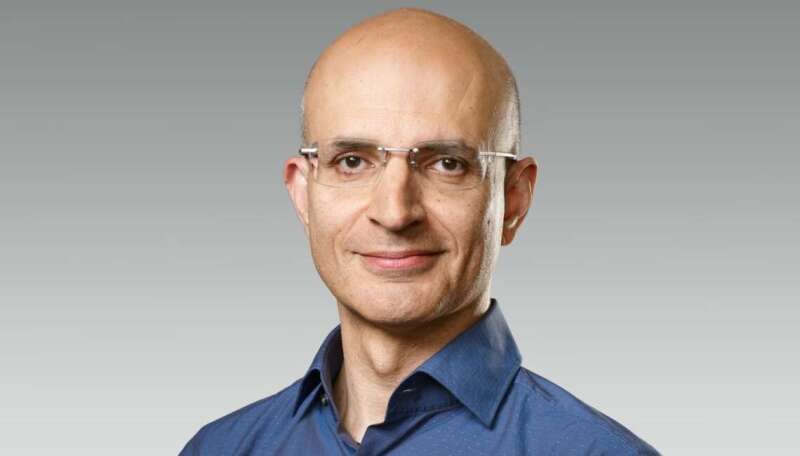

In April, Intel CEO Pat Gelsinger said that he expects the semiconductor industry to suffer supply shortages until 2024….reports Asian Lite News

Chip-maker Intel is rising prices on a broad range of microprocessors owing to a supply-chain crisis in the tough global macro-economic environment, the media reported on Thursday.

According to Nikkei Asia, the company informed customers that it “will raise prices on a majority of its microprocessors and peripheral chip products later this year, citing rising costs”.

The company is yet to finalise price hikes which could take Intel’s flagship products such as central processing units for servers and computers into account, according to the report.

The hike will also include products like chips for Wi-Fi and other connectivity options.

In April, Intel CEO Pat Gelsinger said that he expects the semiconductor industry to suffer supply shortages until 2024.

Gelsinger explained that the issue may drag on due to a lack of key manufacturing components.

“In the supply chain, lockdowns in Shanghai and the war in Ukraine have demonstrated more than ever that the world needs more resilient and more geographically balanced semiconductor manufacturing,” he said.

The chip shortage cost the US economy $240 billion last year.

“We expect the industry will continue to see challenges until at least 2024 in areas like foundry capacity and tool availability,” Gelsinger noted.

According to Counterpoint research, Global semiconductor chip shortages are likely to continue easing during the second half of 2022 as demand-supply gaps decrease across most components

Meanwhile, Global cellular IoT module chipset shipments grew 35 per cent (on-year) in the first quarter this year, and Qualcomm led the market with 42 per cent share and 30 per cent growth across nine out of the 10 key regions globally, a new report has said.

China was the key region for cellular IoT module chipset consumption during the quarter, reports Counterpoint Research.

PC, router/CPE and industrial were the top three applications for 5G.

“Qualcomm, UNISOC and ASR held the top three positions in the global cellular IoT module chipset market in Q1 2022, accounting for nearly 75 per cent of the total shipments,” said research analyst Anish Khajuria.

Qualcomm has been broadening its IoT chipset portfolio, targeting premium 4G and 5G solutions for verticals such as retail, automotive, industrial robotics and smart cities.

It is also collaborating with several industry application and technology providers, including Microsoft, ZTE, BMW and Bosch, to focus on high-value artificial intelligence and 5G IoT capabilities, also termed as the 5G AIoT segment, the repoert mentioned.

“The cellular modem chipset competition is heating up in the IoT module space with a growing number of players entering the higher-volume LPWA and lower-category 4G LTE (Cat 1 and Cat 1 bis) segments,” said Vice President Research, Neil Shah.

“However, the low-power and less advanced applications will continue to prevail into the next decade and we could see some adoption of SoC-based integrated solutions, Shah added.