Xi is banking on a combination of cheap Russian energy and Chinese manufacturing to turbocharge the PRC’s geopolitical challenge to the democracies, at a time when the West is scoring self-goal after self-goal, writes Prof. Madhav Nalapat

Within policymaking bodies in the Lutyens Zone, fragments of Chindia (the assumed synergistic fusion between India and China) still litter some minds. Deng Xiaoping began his wooing of India with the 1981 opening of a route from India to Kailas Mansarovar. Since then, trade between India and China has ballooned, and is presently witnessing a surplus of trade in that country’s favour that has crossed US$80 billion. Although Deng kept the PLA on a leash, the military was set free under Jiang Zemin and Hu Jintao. Salami-sliced expansion further into India of the Line of Actual Control (which remains unrecognized by Beijing) co-existed with honeyed language from PRC diplomats and interlocuters.

Until the always visibly assertive, often aggressive Xi Jinping took charge as CCP General Secretary in 2012, the promise of Chindia was kept alive even though Beijing refused to backtrack on border issues, all the while deepening its cooperation with GHQ Rawalpindi, including through providing logistical and other support in operations directed at India. While Aksai Chin has from the 1950s been occupied by China, after Xi’s ascent to the highest office in his country, Pakistan-occupied Kashmir too has entered on a path of becoming a protectorate of the PRC, with the eager consent of the Pakistan Army.

Since the second 5-year term of Xi began, hardly any attention has been given to the concept of the Russia-India-China axis, while intense effort has gone into strengthening the bilateral relationship between Beijing and Moscow. It is no secret that the CCP considers large chunks of Siberian land as having been taken from China by Russia in the past. Nor that Xi’s desire is to dominate the European part of Eurasia once he manages to establish not just ascendancy but control over the Asian part. In such a schema, Moscow will need to be content to serve as a junior partner to Beijing, a status that Moscow appears to have silently accepted.

CHINA-RUSSIA CONFLICT UNLIKELY

Despite their historical differences, once the Sino-Russian boundary was officially demarcated by mutual agreement, a kinetic conflict between the two countries comprising “Chissia” has become very unlikely. In contrast, China has refused to enter into a boundary settlement with India, thereby reserving the right to launch another border conflict in the future. A warning bell was the distribution by the PRC delegation of maps of the SCO countries during the 15-16 September Samarkand summit. These maps show Arunachal and Ladakh as part of China, and Kashmir as part of Pakistan. There was no bilateral between Prime Minister Narendra Modi and Xi Jinping in the SCO summit, unlike in the past.

Since 2016, India has been moving from chasing the illusion of Chindia into factoring in the reality of Chissia. Unlike his predecessors, Prime Minister Narendra Modi, from the start of his coming to power in 2014, was clear-eyed about the objectives of the CCP leadership core, and has strengthened military defences on the boundary with China in a way not seen earlier. Now that Xi has secured a third term, he needs to deliver on his promise of expanding the territorial boundaries of the PRC before seeking his fourth (and possibly final) 5-year term in 2027. Given that the ASEAN Sea (otherwise known as the South China Sea) has substantially come under Chinese occupation, that leaves Taiwan and lands south of the Himalayas as obvious targets for attempts at takeover through the PLA.

XI WANTS UKRAINE WAR TO CONTINUE

While NATO capitals have from the start of the 24 February 2022 Russian invasion of Ukraine believed that Xi could be persuaded to reel back Vladimir Putin from his adventure, the reality is that the CCP leadership core prefers that the ongoing proxy conflict between NATO and the Russian Federation continues well into 2023. As a consequence, the bulk of the financial and other resources needed by Moscow to prosecute the war have their origin in China. Since the start of the year, Xi has studied the sanctions imposed on Russia and begun taking preventive steps designed to reduce to a minimum damage done to China in the event of similar sanctions being imposed on the PRC by NATO member states together with Japan, Australia and South Korea.

Chinese dollar (as well as euro, Swiss franc and Japanese yen) reserves are in the process of being replaced, including with additions to the official gold stock. If the silent effort at depreciating the RMB yuan to 8 per dollar is judged insufficient to boost exports in a depressed global market, the level of 10 RMB to a dollar would be the next step, followed by the Hong Kong dollar (HKD) snapping its peg to the US dollar. That peg has tied Hong Kong to the policies of the US Federal Reserve, which seems to be set on a course that would make the US a more and more expensive location to invest in, and to produce and sell from. A higher USD would raise the debt burden on countries that have been given Belt & Road Initiative loans, all of which have been dollar denominated.

As a consequence, physical assets worth inflated sums of money would come into the ownership of China from countries unable to repay BRI debt on the lines already witnessed in some countries. The risks to China from Taiwan-related sanctions by western countries that have been hyperactive in sanctioning Russia are being sought to be minimised through an increasing volume of commodity trade being settled in currencies other than USD. This would be helpful in the worst case scenario of the US Federal Reserve seeking to confiscate or starve China of access to USD.

Under Prime Minister Modi, countermoves in the event of kinetic scenarios involving the PLA are being worked out. Similar is the case in Taiwan, where the central government has been active in dealing with the risks inherent in Xi’s penchant for expansionism. If further proof of Xi’s intentions towards India are needed, unlike in the case with Russia, the PRC has insisted that the surplus secured through Chinese exports to India should be paid in USD and not through a rupee-yuan arrangement, with predictable consequences for the dollar-rupee ratio.

HIGH USD FUELS GLOBAL INFLATION

Given the economic and social carnage wreaked as a consequence of the 2020 Covid-19 pandemic caused by a lab leak from the Wuhan Institute of Virology, the manner in which boomeranging sanctions were imposed by NATO members has created choppy waters for the global economy. In a panic reaction to the pandemic in 2020, unprecedented lockdowns were implemented by numerous governments that had severe effects on the economies of the countries enforcing them. In attempts to mitigate the pain caused by the lockdowns, the US Federal Reserve and some other central banks unleashed Quantitative Easing (QE) directly into fiscal injections of liquidity. Such boosts in money supply led to price rises when conjoined with supply disruptions caused by the pandemic. QE was followed by the US Federal Reserve Board raising interest rates repeatedly since 2021 to “curb inflation”.

Such moves are a throwback to monetary policy in the 1930s, that helped cause the Great Depression, and has had little effect on slowing down inflation, given that much of the price rise was caused by the supply and other disruptions caused by western sanctions imposed on Russia since its invasion of Ukraine. While the USD has shot up in value, this has had a devastating effect on the currencies of several US partners and allies, including in Europe. The debt to GDP ratio in the US has crossed World War II levels together with high inflation and the risk of stagflation to a level last seen in the 1970s. That crisis caused the current monetary system to be born. Another may result in a fresh transformational change that, in the expectation of the Sino-Russian alliance, could see the demise of the USD as the global reserve currency of choice.

WESTERN BANKS ENTER DANGER ZONE

Given the buffeting since 2020 of the Covid-19 and the Ukraine shock, major systemic cracks have started to appear in the US Treasury, which till now has been the anchor asset of global financial system. Treasuries should not be equated with the USD, which remains the global reserve currency, but which has steadily lost ground in the 21st century. Among the reasons why Liz Truss had to make way for Rishi Sunak at 10 Downing Street was fear of a UK pension crisis. Should the Ukraine war and western sanctions on Russia continue, most Western countries may face a similar situation.

Democracies such as those in Europe as well as Japan and Korea may be pushed into a structural trade deficit. At the same time, Chissia has enabled President Putin to resist sanctions by the West. The ruble is among the few currencies that have strengthened against the USD, despite foreign reserve and individual asset confiscations by western countries, measures that have lowered confidence in the safety associated with parking reserves and property in western financial institutions.

Western currencies have in 2022 begun to be perceived as less than a safe reserve, given the shifting geopolitical currents and consequent arbitrary actions taken in countries that prided themselves on the Rule of Law and due process. This may tip several western financial institutions into the danger zone, a point already reached by some such as Credit Suisse. The ban has been harmed as a consequence of Switzerland abandoning its neutrality in the proxy war between the Sino-Russian alliance and NATO. Given that the PRC is the main challenger to the primacy of the West, the dire situation of that grouping has been cause not for alarm but for jubilation in Moscow and Beijing.

COMMUNIST CHINA’S GAME PLAN

Among the scenarios likely to be followed given the context of recent events, the probable game plan of the CCP core appears to be as follows:

Xi depreciates RMB to 8 per US dollar, then subsequently to 10, which may trigger a repeat of the cause of the 1997 Asian Financial Crisis, resembling in its effects the 2008 global financial crisis in scale due to excessive system leverage and diminishing firepower by both fiscal and monetary authorities.

This may coincide with (1) Xi repegging the RMB to gold at a much higher gold price, so to create an arbitrage drain of the already low western physical gold stockpile, and (2) nationwide rollout by China of its digital currency to boost the global credibility of RMB, followed by (3) de-pegging of the HKD to USD and re-pegging of the HKD to RMB. The CCP leadership core anticipates that its covert economic war on overly leveraged economies (such as those of the US and its NATO allies) due to the combined effects of Asia Financial Crisis 2.0 plus physical gold drain could elevate RMB’s international status, including via a repurposed HKD.

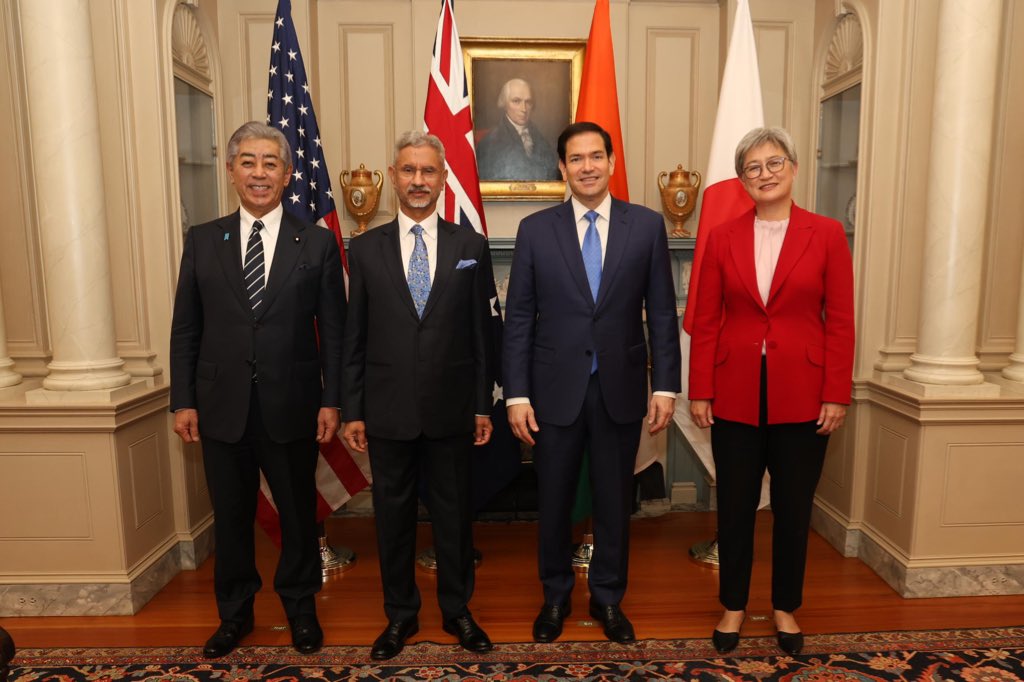

Given the massive increases in the funds made available to the PLA, Xi believes that China is strong enough to seize BRI hard assets and projects into its own control under current contract terms. The snail’s pace of the development of Quad into a full-fledged defence and security alliance is also creating a window for economic and diplomatic power play backed by PLA muscle. When the Quad will be willing and able to offer reassurance to countries at risk of losing control of assets as a consequence of dollar-denominated BRI debt remains an open question.

US MUST AGAIN BE ARSENAL OF DEMOCRACIES

The democracies, though, are not without defences. Rather than lapse into a growth-destructive, inflation-fuelling mode, the US Federal Reserve could be used to promote global growth in democracies, as overall it remains potentially among the most destructive weapon against the enemies of democracy. Despite being infiltrated by the CCP based on recent Congressional reports, the Fed has the capacity to weaponize in defence of US allies. This was evident during the 2020 Covid pandemic via the “FIMA” facility of emergency lending of hard USD to allied countries, but not to China. The US, India and other major democracies have many cards under their sleeve. Their outcomes would of course depend on strategic awareness (including grey zone warfare initiatives) and the speed of recognition of threats and implementation of counter measures to disruptive actions carried out by the Sino-Russian alliance (Chissia).

The developing situation is causing a realignment within the global community of the traditional three axes of power. These are (1) energy/commodities such as OPEC, (2) labour/production where China is the present and the future is India, as well as (3) capital, including GCC. The severing of the collaborating links among the three caused by the twin shocks of Covid-19 and the Ukraine war marked the end of structurally low inflation, low interest rates and low geopolitical risks. Xi is banking on a combination of cheap Russian energy and Chinese manufacturing so as to turbocharge the PRC’s geopolitical challenge to the democracies, at a time when the West is scoring self-goal after self-goal. India does not have the luxury of remaining on the sidelines, but needs to position itself in the ongoing contest between the democracies and the countries that regard such a system as anathema. Calculations as to what is the best way of doing this would be going on in the Prime Minister’s Office at South Block on an almost daily basis.